First Home Finance (FLISP) 2026: Government Can Pay Up to R169,000 for Your First Home

Have you ever wondered how the South African government helps first-time buyers afford a home? The flisp first home finance subsidy 2026 amounts might just be what you need to know. It could change the way you plan for your new house.

Buying your first home can feel overwhelming, especially when finances seem tight. Did you know the government offers subsidies that can significantly reduce your initial costs? This support can ease your path to ownership more than you might expect.

Stick around, and I’ll walk you through how these amounts work in 2026 and what it takes to benefit. This could be the boost that makes your dream home a reality.

Understanding Flisp First Home Finance Subsidy 2026 Amounts And How To Qualify

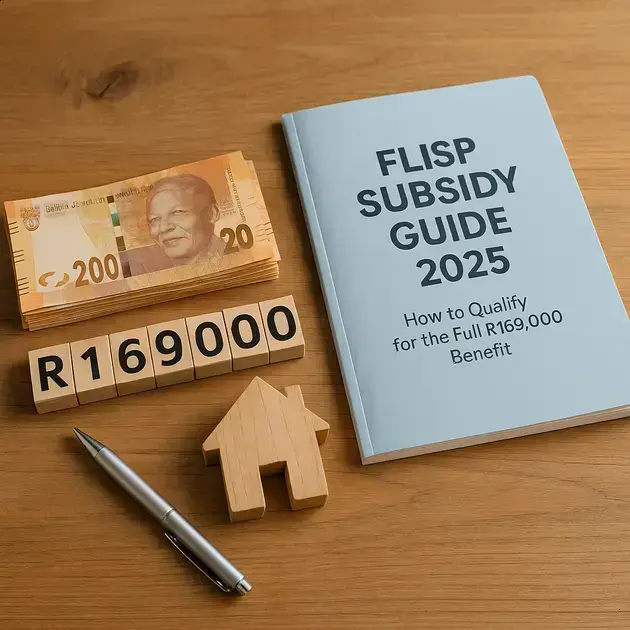

FLISP (First-Time Homeowners’ Subsidy) is designed to help first-time buyers afford a home in South Africa by providing a financial boost. For 2026, the subsidy amount depends on your income and the property value, with grants reaching up to R169,000. This can make a big difference in reducing your home loan and monthly payments.

The exact subsidy you receive is calculated based on a sliding scale. Applicants earning between R3,501 and R22,000 per month stand to benefit the most, as FLISP targets middle-income earners who struggle to buy a home outright. The government adjusts the subsidy to fit within your affordability.

To qualify, you must be a South African citizen or permanent resident, over 18 years old, and not own any property currently. The property you buy should be for your own use and not as an investment. You also need a pre-approved home loan from a bank or financial institution before applying for FLISP.

Applying for the FLISP subsidy involves submitting proof of income, identity documents, home loan approval, and details about the property. It’s important to ensure your application is complete for faster processing. Many housing agents and financial advisors can assist with the application process to increase your chances of success.

Using FLISP means you can access better housing opportunities sooner than without this subsidy. It lowers the financial barrier and helps you settle into your first home comfortably. Understanding the amounts and qualifications is the first step toward making your homeownership dreams a reality in 2026.

FAQ – Frequently Asked Questions About FLISP First Home Finance Subsidy 2026 Amounts

What is the FLISP subsidy and who is it for?

FLISP is a government grant that helps first-time homebuyers in South Africa, especially those with moderate incomes, to afford their first home.

How much subsidy can I receive from FLISP in 2026?

You can receive up to R169,000 depending on your monthly income and the value of the property you intend to purchase.

What are the eligibility criteria for the FLISP subsidy?

You must be a South African citizen or permanent resident, over 18, a first-time homebuyer, and have a home loan pre-approved by a bank or financial institution.

Can the FLISP subsidy be used for any type of property?

The subsidy must be used to purchase a residential property that will be your primary home, not for investment or rental purposes.

What documents do I need to apply for the FLISP subsidy?

You will need your ID, proof of income, home loan approval documents, and details of the property you want to buy.

How long does it take to receive the FLISP subsidy after application?

Processing times can vary, but typically, once your application is complete and approved, it may take several weeks to receive the subsidy.